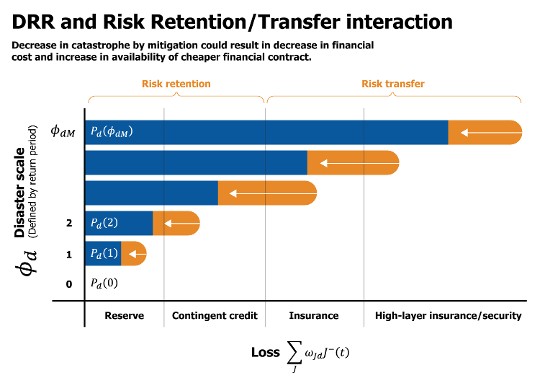

'Risk-layering' strategies to reduce, retain and transfer disaster risk not only protect productive assets and lives, but implemented appropriately, could yield a number of additional benefits that could enhance wellbeing and resilience. Yet, conventional static macroeconomic models are not capable of analysing how alternative fiscal resource allocations to risk-layering options may affect developing countries’ growth trajectories under the impact of climate change.

© IIASA

© IIASA

This project hence develops a new dynamic and stochastic macroeconomic framework capable of analysing sustainable growth implications of climate extreme risk management in developing countries. The proposed dynamic macroeconomic model captures a forward-looking rational expectation of a representative household and firm, whose perception of future earnings and losses will be affected by the prevailing levels of climate extreme risk and DRR investment. These changes will then affect other aspects of economic activities such as the optimal levels of saving and investment, demands for labor and capital, shares of import/export and ultimately a country’s GDP growth trajectory. The interaction between DRR investment and risk retention/transfer instruments will be analysed as policy scenarios in this study.

The project estimates the benefits of DRR as applied to coastal hazard management in Barbados in collaboration with the InterAmerican Development Bank (IDB).

Funding Partner: Inter-American Bank

Additional relevant publications

Ishiwata, H., & Yokomatsu, M. (2018). Dynamic Stochastic Macroeconomic Model of Disaster Risk Reduction Investment in Developing Countries. Risk Analysis, 38(11), 2424-2440.

Yokomatsu, M. (2018). A Commentary on “Recovery from Catastrophe and Building Back Better (Takeuchi and Tanaka, 2016)”–Structure of Damage of Production Capital Stock on Normative Economic Process. Journal of Disaster Research, 13(3), 564-570.