The Austrian government launched its climate and energy strategy in 2018 aimed at decarbonizing production and consumption and creating opportunities for green growth. Recent research shows that Austria is facing the challenge of aligning its greenhouse gases (GHG) emissions to the EU2030 targets and a green investment gap has to be filled. There is an urgent need to understand the conditions for an effective scaling-up of green finance in the Austrian economy and financial market, while avoiding trade-offs for economic competitiveness and financial stability.

© IIASA

© IIASA

Objectives

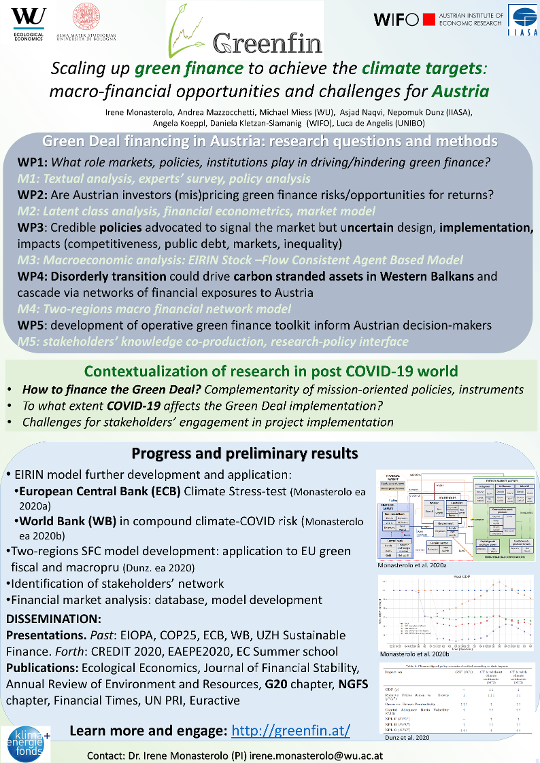

The GreenFin project aims to assess the conditions for scaling up green finance in Austria while avoiding trade-offs on macroeconomic performance, and financial stability and inequality, against a scenario of inaction. Green finance paths characterised by different market instruments, mission-oriented green policies and governance structures will be assessed in terms of their ability to foster green investments, economic competitiveness, fiscal and financial stability, i.e., a green new deal.

IIASA Research

The GreenFin project is interdisciplinary with regard to the research questions, the methodologies and the expertise applied. It consists of five major research steps:

- A comprehensive review of current sustainable finance initiatives, instruments and mechanisms with a broad geographical coverage.

- Financial econometric models to test Austrian investors’ reactions to the Paris Agreement, and the conditions for green financial portfolios to outperform brown portfolios.

- Macro-financial assessment of the introduction of green fiscal policies, financial regulation and green bonds in Austria.

- A North-South model to assess macroeconomic and financial effects of greening Austrian development finance on the beneficiary countries in the Western Balkans.

- Toolkit to support Austrian policy and decision- makers in their ex-ante evaluation of initiatives for scaling up green finance.