Policy Brief #24, July 2019. Investment in low-carbon energy is making a difference. IIASA research now provides decision makers with valuable data on the capital required to ramp up renewables, boost energy efficiency, redirect energy portfolios, and fill investment gaps.

- According to the researchers, current Nationally Determined Contributions (NDCs) will not provide the needed impetus to transform the global energy system away from fossil fuels to low-carbon and renewables. To overcome this problem, policymakers need to address a significant low-carbon and renewable energy investment gap. Based on this work, several key recommendations were drawn up for policymakers.

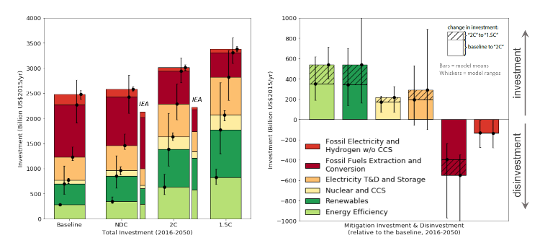

- Energy investment portfolios must undergo pronounced shifts from fossil fuels (especially coal) to low-carbon and energy efficiency.

- Renewable energy and energy efficiency investments each need to increase by up to US$550 billion on average per year until 2050 in order to achieve the 1.5°C target.

- Fossil-fuel energy disinvestment needs to occur at a rate roughly equivalent to the increase in low-carbon investment.

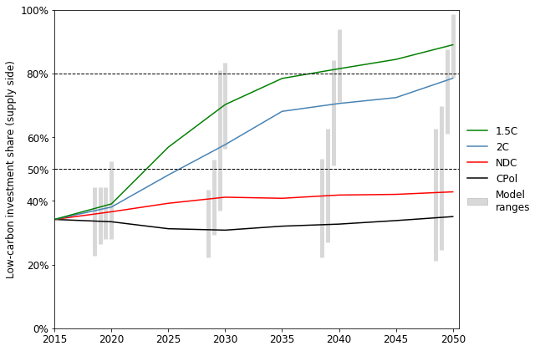

- Low-carbon investment needs to account for more than 50% of all energy supply investments by around 2025, climbing to 80% or greater by around 2035.

- An annual investment gap of between US$300 and US$460 billion in low-carbon and energy efficiency must be filled between now and 2030 if the Paris Agreement targets are to be reached.

© IIASA

© IIASA

Figure 1. Projected global average annual investments in the different climate policy scenarios (left panel); incremental investments and disinvestments by category relative to the baseline (right panel).

Addressing the energy investment gap

The Paris Agreement calls for “making finance flows consistent with a pathway towards low greenhouse gas emissions and climate-resilient development” in order to keep temperature increases well below 2°C while pursuing a 1.5°C limit. To achieve this, a transformation of the global energy system away from fossil-fuels to low-carbon and renewables is necessary and will inevitably require a profound reallocation of the investment portfolio. IIASA research shows that current Nationally Determined Contributions (NDCs) will not provide the impetus for this structural shift and policymakers need to address a significant low-carbon and renewable energy investment gap.

Current Trends

Investment in clean-energy and in energy efficiency has grown rapidly over several decades. This has been driven by government policy choices and consumer demand. Investment flows into renewable electricity have in fact exceeded fossil electricity investments for more than a decade. However, when upstream coal, oil, and gas extraction are accounted for, fossil energy investments still dominate in the total mix. These trends are likely to continue unless there is a strong global policy push to align energy investment portfolios with achieving the Paris Agreement targets of 2°C and 1.5°C.

Impact of future energy and climate policies

An analysis of the current suite of countries’ climate pledges (NDCs) indicates that only a marginal increase in total future investments will be required to meet those commitments. However, this would not address the more urgent need – transitioning the global economy toward a future consistent with a well below 2°C temperature rise. For this, policies sufficiently ambitious to tackle deep decarbonisation and the transformation of the global energy system are called for. This means a marked increase in clean energy investments. For example, low-carbon supply-side investments would need to overtake fossil investments by around 2025 or earlier. To put it another way, at the same time that investment in clean energy and efficiency is scaled up, investment in fossil energy will have to be scaled down. This has important benefits beyond meeting climate targets, for instance, reduced air pollution.

Filling low-carbon energy investment gaps

Investments are a powerful tool for policymakers and investors to address greenhouse gas emissions and thus progress towards climate targets. Quantifying the relevant “investment gaps”, that is the investment needed beyond what is already committed, will enable stronger policies and more effective investment. Achieving the current NDC pledges, for example, implies a global near-term (to 2030) low-carbon and energy efficiency investment gap of approximately US$130 billion per year. Put differently, that means a gap of around 7% of all global energy investments made in 2015 needs to be filled over the next several years; a significant investment policy challenge that becomes even greater if the Paris Agreement targets are to be achieved.

The IIASA study deals with quantifying investment needs rather than sources for the required capital but notes multiple possibilities such as businesses, governments, households, banks (private, state-owned or development), and multi-lateral climate finance institutions. It also points out that the ultimate funding portfolio, from macro to micro-scale, will be determined by some mixture of the world’s financial systems, countries’ fiscal and monetary policies, and foreign development aid institutions, among others. In addition, the study deals with the impact of energy investment on other aspects of development goals, for instance, clean and efficient energy such as solar and wind power obviates the need for investing in expensive technologies for air pollution control.

© IIASA

© IIASA

Figure 2. Projected global average annual low-carbon energy supply-side investments as a share of total supply-side investments. Solid lines represent multi-model means; floating bars give the min-max ranges across the models. Estimates shown here include

Conclusions

- Investment pledges made in the NDCs over the past two years are a move in the right direction, but are wholly insufficient for the deep structural changes required in the energy investment portfolio to achieve the low-temperature targets of the Paris Agreement.

- G20 countries have ‘reemphasized’ a commitment by wealthy countries to jointly mobilize US$100 billion between 2020 and 2025 for climate mitigation actions in developing countries. According to the IIASA analysis, this level of support would go a long way toward closing – if not fully covering – the low-carbon energy and energy efficiency investment gap faced by developing countries working to fulfill their NDC commitments.

- Considerably more capital would have to be mobilized in order to fully close the investment gap to meet a 2°C or 1.5 °C target.

All investment data supporting this analysis, along with a host of other data describing the various scenarios discussed here (e.g., energy and emissions time-series by fuel sector and region), are available in the publicly accessible CD-LINKS Scenario Database: db1.ene.iiasa.ac.at/CDLINKSDB

IIASA Policy Briefs report on research carried out at IIASA and have received only limited review. Views or opinions expressed herein do not necessarily represent those of the institute, its National Member Organizations, or other organizations supporting the work.