Julian Joseph writes about a recent study in which researchers used a novel concept in the economic modeling of disaster risk reduction to explore how damages from disasters can be compensated for and what effect they have on economic growth.

When disasters hit a country, factories, machines, and infrastructure can be destroyed. How can these damages be compensated for and what effect do they have on economic growth? In a recent study, my colleagues and I used a novel concept in the economic modeling of disaster risk reduction namely, the combination and layering of financial instruments, to tackle this question with a focus on infrastructure for reducing risk and damage incurred by disasters.

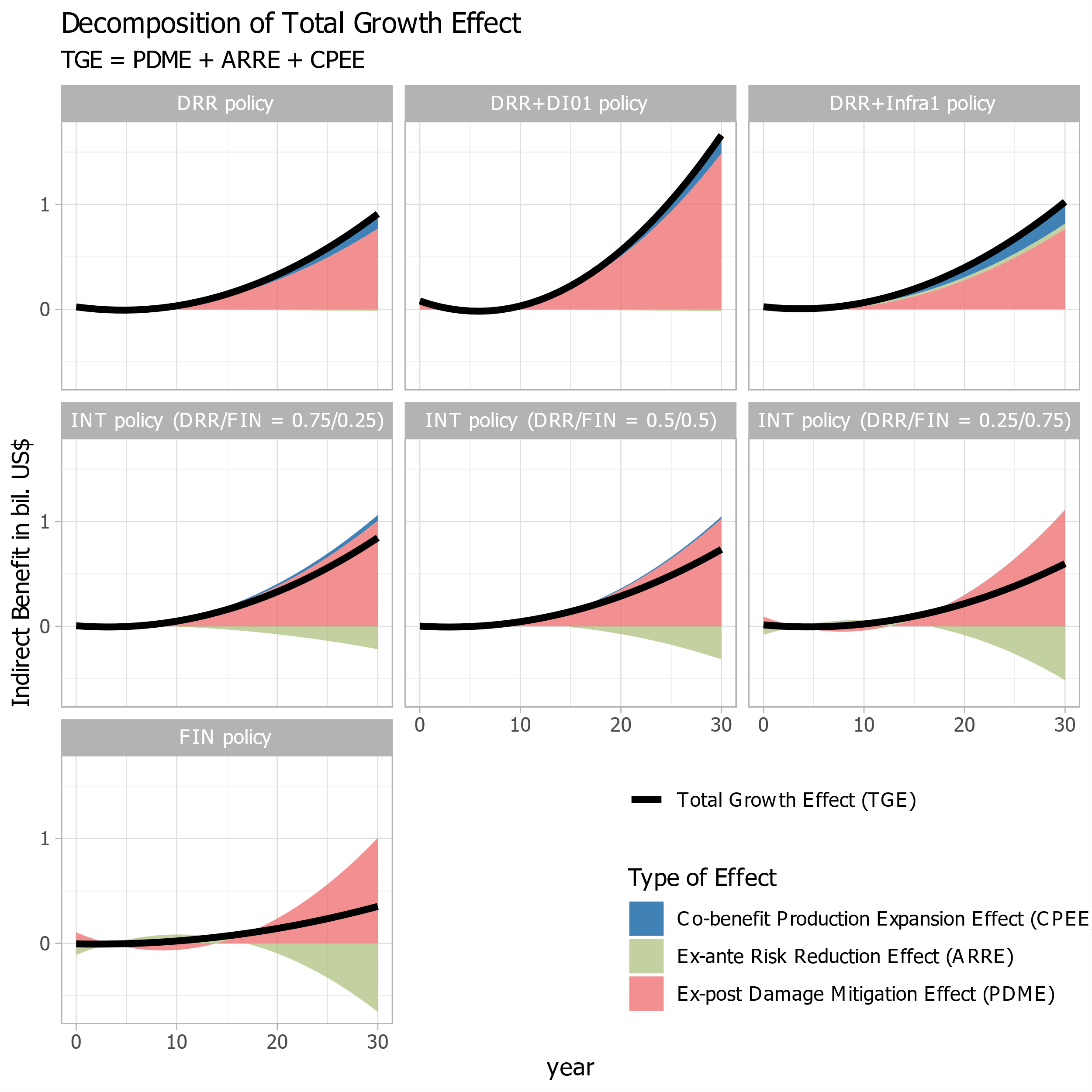

In addition to standard investments in disaster risk reduction (DRR), we included adaptive financial contracts that are triggered at different disaster scales in our economic growth model. This can help policymakers and researchers determine the effects of a policy mix of different financial instruments and DRR on economic growth. Understanding which instruments are used for which disasters and through which channels this can lead to economic growth, is a key question for societies aiming to reduce disaster risks and their negative impacts.

To understand the need for modeling and evaluating layers of financial instruments simultaneously with DRR, it is essential to link the magnitude of a disaster to the response taken by the government to finance rebuilding infrastructure and other assets. When shocks to the economy caused by the disaster are small, it might be sufficient to invest small amounts without taking up loans or receiving insurance payments. As the scale of destruction becomes larger, higher investments will be needed to rebuild resources essential for producing output in the economy.

Two major links between growth, financial instruments, and disaster risk reduction are most important for this analysis. On the one hand, premiums for insurance depend on the level of economic losses potential disasters can cause. Thus, for low levels of DRR and resulting high levels of damage, insurance will be costly, making it more profitable in economic terms to invest in DRR before insurance. On the other hand, high economic growth can help reduce payments for financial contracts. If growth is high, there are often more financial means available from reserves and loans, reducing the need for expensive insurance.

To provide scientific guidance on budgeting for disasters for the incoming head of state for the island economy of Barbados, our team applied the simultaneous modeling for DRR and financial instruments. The country had the opportunity to invest in physical disaster risk reduction infrastructure, such as dikes to prevent flood damage, or in risk finance instruments. Therefore, we asked which share of infrastructure and layered finance instruments is best for sustaining economic growth. Our study, published with the Inter-American Development Bank, found that, in the long term, rising insurance premiums after multiple hurricanes lead to higher overall government liabilities, reducing the opportunities to invest in other growth-enhancing opportunities.

In this and many other cases, building infrastructure with additional benefits fares better than financial contracts in terms of the GDP growth it generates. This is because of the co-benefits of investments such as the widening of beaches, which could add value for the tourism sector.

There are also benefits attached to layered finance: When these instruments are chosen, the volatility of economic growth can be reduced. When disasters strike in this setting, the financial payments by governments, loans, or insurance act counter-cyclically to the reduction in capital and subsequently economic output. In contrast, infrastructure investments are commonly once-off (with the exception of maintenance costs) and not aligned with business cycles.

© IDB

© IDB

Modeled average economic growth effect of disaster risk reduction (DRR), Infrastructure (Infra), integrated (INT) and layered financial instruments (FIN) in Barbados

So what is the optimal policy to sustain growth in the Barbadian economy? We found that focusing on DRR investments, ideally supported by additional investments in productive infrastructure leads to the highest growth rates. Besides the reasons outlined above, the low initial levels of DRR infrastructure in the country are an important reason for this result. While increasing the share of financial instruments such as insurance for disasters still increases growth or has a net positive total growth effect, the magnitude is significantly lower than in the first case.

Integrating the complexity of layered financial instruments and its interactions with DRR investment in the economic assessment of disaster risk reduction investments is key to understanding questions of economic growth and underlying mechanisms. The results of studies of this type, including the Dynamic Model of Multi-Hazard Mitigation Co-Benefits (DYNAMMICS), are an advancement to understanding the relevance of investments for the magnitude and volatility of growth. These two measures can however be subject to trade-offs. Thus, informed decision making can help find a preferred share to enhance growth while keeping volatility at an acceptable level. To enhance the model’s capability to provide this important decision guidance, we are planning to update it in the future with a Bayesian estimation mechanism, which will make it more widely applicable and reduce the number of assumptions and data needed.

Note: This article gives the views of the author, and not the position of the Nexus blog, nor of the International Institute for Applied Systems Analysis.