Policy Brief #39, September 2023. The strong support for nature-based solutions voiced by the European Commission will require urgent policy reforms if Member States are to fulfil the United Nation’s ambition of tripling investments in nature by 2030 to meet climate and biodiversity targets.

Nature-based solutions (NBS) face distinct policy and financing barriers that differentiate them from conventional grey infrastructure. The lack of evidence on their efficacy and co-benefits poses an almost intractable challenge to public authorities and private businesses intent on justifying NBS over their conventional counterparts. For many NBS, this evidence will not be forthcoming in time for their urgent scale up. Moreover, entrenched institutional, regulatory, and financial factors or ‘grey path dependency’ inadvertently enable conventional infrastructure. To add to the challenges, the public-good nature of most NBS means few bankable projects in contrast, for example, to private investments in renewable energy.

To tackle these and other hurdles facing NBS infrastructure the following policy reforms could contribute to fundamentally changing the NBS enabling environment:

- Extend the scope of the EU Environmental Impact Assessment (EIA) Directive.

- Switch the burden of proof from NBS to grey infrastructure.

- Exempt selected NBS from the EIA.

- De-risk NBS with public instruments.

- Support public and private NBS financing.

- Promote divestment from nature-negative assets.

If environmental impact assessments become mandatory for a larger set of infrastructure proposals and if proposers are obliged to provide extensive accounting of the biodiversity and climate impacts over an appropriately lengthy time horizon at a low discount rate, this will effectively switch the burden of proof since it would mean that NBS are assumed to be the preferred option unless the grey solution is proven superior. If, in addition, selected NBS are exempt from the EIA process, this will help tackle grey path dependency. Moreover, increasing public financing for NBS even beyond what is currently planned will help circumvent the NBS public-good challenge by enabling both public and private investment. Reducing liability risk to NBS owners will further contribute to the urgent scaling of NBS. Perhaps most importantly, strengthening implementation of the EU Taxonomy to identify and even require nature-negative divestment can critically redirect financing to NBS.

The challenge ahead

Fulfilling the United Nation’s ambition of tripling financial flows to nature-based solutions (NBS) by 2030 will require a multi-faceted understanding of the enablers and barriers to NBS implementation, particularly those factors that make NBS especially thorny to put into operation. As part of the EU HORIZON 2020 PHUSICOS project, researchers at IIASA, the University of Geneva, and the Norwegian Geotechnical Institute have identified the enablers and barriers for both NBS and grey infrastructure, focusing mainly on disaster risk reduction. The research is based on systematic literature surveys and meta-analyses, discussions at the PHUSICOS Policy-Business Forum, as well as semi-structured interviews with public-sector entities and private-sector professionals working on the provision of NBS services across Europe.

NBS and grey infrastructure barriers

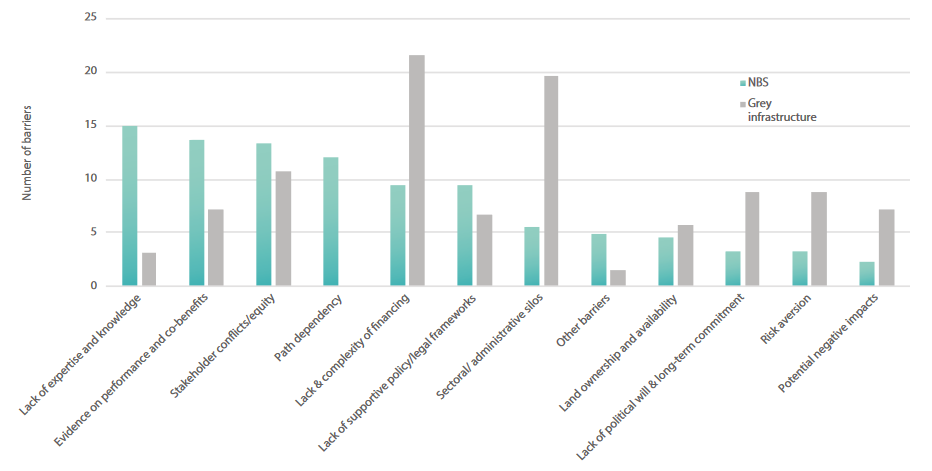

Twelve implementation barrier clusters shown in the figure were identified, many of which afflict NBS and grey infrastructure alike, including:

- Stakeholder opposition.

- Lack and complexity of financing.

- Supportive policy and legal frameworks.

- Sectoral and administrative silos.

- Lack of long-term commitment.

Meeting the challenge

The NBS community can learn from how these and other challenges have been surmounted for grey infrastructure. Most notably, this includes inclusive co-generation stakeholder processes, streamlined procurement procedures, the development of sustainable building codes, novel polycentric governance arrangements, and (exceptionally) independent institutions for implementing long-term infrastructure. The NBS community can also learn from grey business models and novel instruments, including payments for ecosystem services, biodiversity offsets, green and resilience bonds, consideration of a new asset class for infrastructure, and recent novel insurance instruments.

Distinctive NBS barriers

As crucial as these and other policy lessons are, they fall short of addressing those hurdles that make NBS distinct from grey projects and exceptionally difficult to put into operation, including:

- Lack of expertise and knowledge, the most mentioned barrier in the literature, which limits the capacity to carry out NBS projects. Two interviewees from companies specialized in the design and execution of NBS depict this barrier as a leading challenge.

“Still today our main problem is having people that can work with us. Sometimes we tell our customers that we cannot do the work because we do not have people.”

“Our problem is that nature-based solutions are very multidisciplinary projects. All the different partners must work in areas that are outside their comfort zone, that are new to them, which causes them a little bit of hesitation.”

- Lack of evidence on performance and co-benefits, which poses challenges for policymakers and their consultants in justifying NBS over conventional grey projects. More than half of the public authority interviewees stated that the lack of solid information and concrete data to demonstrate the effectiveness and co-benefits of NBS is a difficulty they face continuously. This was also a problem for NBS consultants, as one interviewee put it:

“I know if I buy concrete the engineers can tell me exactly what it will stop, but you guys (NBS proposers) cannot. So that is a big problem.”

- Grey path dependency, which arises due to entrenched institutional, regulatory, and financial factors, as well as technical considerations, inadvertently enables conventional infrastructure. It afflicts public authorities and private contractors alike, as voiced by one interviewee:

“What I see is that both designers and construction companies are used to pouring concrete, but they are not used to using the solutions that nature often offers and that are equally or even more efficient.”

- Financing challenges are not unique to NBS, yet a crucial difference is emerging. The public-good nature of many, if not most NBS, means few bankable projects in contrast to many private investments, for instance, in telecommunications, water services, public transport, and most recently, renewable energy infrastructure. This will put strain on already stressed public budgets as expressed by a county official:

“When you have such small municipalities, the administrative resources are also small, and therefore I do not have much faith that this type of solution (NBS) can be achieved in these municipalities […]”.

Suggestions for urgent policy reforms

The suggested reforms respond particularly to these distinctive NBS hurdles and, importantly, are based on historical practice and precedent.

- Extend the scope of the EU Environmental Impact Assessment Directive

The European Commission might consider extending the scope of mandatory environmental impact assessments (EIAs), which are typically carried out only for very large projects, coupled with the requirement that proposers of grey solutions consider NBS as an alternative (recent Norwegian legislation recommends this). Additionally, proposers could be required to formally assess impacts over an extended time horizon with a zero or low discount rate. - Switch the burden of proof

Switching the burden of proof, a core concept underlying the EU precautionary principle, would mean that NBS are assumed to be the preferred option unless the grey solution is proven superior. The rationale for this shift is the near-intractable problem, despite important recent guidelines, of estimating NBS effectiveness and co-benefits given the current lack of experience and data. - Exempt selected NBS from the EIA

The European Commission recently exempted certain renewable energy projects from lengthy EIA procedures. In a similar way, selected NBS might receive an exemption or be subject to a streamlined process, thus helping to break grey path dependency. - De-risk NBS

In contrast to construction and storm-damage risk, liability risk from non-performing NBS is not easily transferrable to private insurers. Building on historical precedent of government guarantees for risky but socially desirable investments, NBS liability risk could be transferred from NBS owners and permitting authorities to an appropriate vehicle at the national or EU scale. - Support public and private NBS financing

Although expectations are high that private financing can contribute significantly to closing the NBS financing gap, the public-good character of NBS is a formidable challenge. Already, most NBS funding comes from public sources, which will increase, for instance, as part of the European Green Deal. Still, if municipal and national governments take the lead, they will need enlarged budgets to enable NBS investments, to carry out costly EIA procedures, and to support private investment, with subsidies, guarantees, and blended finance models. - Promote divestment from nature-negative assets

The most powerful instrument is likely the planned extension of the EU Taxonomy to encourage divestment from nature-negative assets, which could be made more effective if mandatory and accompanied with an enforcement mechanism.

Reshaping NBS governance will be crucial for making the urgent NBS investments necessary for meeting the EU biodiversity and climate goals. We hope this research and the suggested reforms will spur further research and, most importantly, deep deliberation across all affected and interested persons and institutions on transformative pathways forward.

About the PHUSICOS project

PHUSICOS is an EU Horizon 2020 project (Grant agreement No. 776681; https://phusicos.eu/), which demonstrates how nature-based solutions provide robust, sustainable, and cost-effective measures for reducing the risk of extreme weather events in rural mountain landscapes. This research was carried out by the IIASA PHUSICOS team from the Equity and Justice Research Group consisting of JoAnne Linnerooth-Bayer, Juliette Martin, and Alberto Fresolone, together with Anna Scolobig and Julia Aguilera Rodríguez from the University of Geneva, and Anders Solheim, Stiine Olsen, and Elisabeth Reutz from the Norwegian Geotechnical Institute.

We also greatly acknowledge the valuable comments from Bjørn Kalsnes and Amy Oen.

The Policy Brief reflects the authors’ views and not those of the PHUSICOS partners or the European Community.

References

Linnerooth-Bayer, J., Scolobig, A., Aguilera Rodríguez, J. J., Fresolone-Caparrós, A., Olsen, S.G., Hoffstad Reutz, E., Martin, J.C.G, Solheim., A. (2023). Learning from NBS implementation barriers, Deliverable 5.4 of the PHUSICOS project, According to Nature. Nature based solutions to reduce risks in mountain landscapes, EC H2020 Programme. https://phusicos.eu/publication-results/

Scolobig, A., Martin, J.C.G., Linnerooth-Bayer, J., Aguilera Rodríguez J. J., Balsiger J., Del Seppia N., Fresolone A., Garcia E. Kraushaar S., Vergès D., Wulff Knusten T., Zingraff-Hamed A. (2023). Governance innovation for the design, financing and implementation of NBS, and their application to the concept and demonstration projects, Deliverable 5.3 of the PHUSICOS project, According to Nature. Nature based solutions to reduce risks in mountain landscapes, EC H2020 Programme. https://phusicos.eu/publication-results/

Martin, J.C.G., Irshaid, J., Linnerooth-Bayer, J., Scolobig, A., Aguilera Rodríguez J. J., Fresolone-Caparrós A., (2023). Opportunities and barriers to NBS at the EU, national, regional and local scales, with suggested reforms and innovation, Deliverable 5.2 of the PHUSICOS project, According to Nature. Nature based solutions to reduce risks in mountain landscapes, EC H2020 Programme. https://phusicos.eu/publication-results/

United Nations Environment Programme (UNEP) (2022). State of Finance for Nature. Time to act: Doubling investment by 2025 and eliminating nature-negative finance flows. https://wedocs.unep.org/20.500.11822/41333