Policy Brief #32, October 2021. A comprehensive risk finance framework supports the identification of international funding options for reducing climate-related risk and addressing residual impacts beyond adaptation in vulnerable countries.

© IIASA

© IIASA

Policy Brief #32, cover

- Faced with increasing climate-related risks, decision makers across the globe need to strengthen and transform climate risk management approaches before limits to adaptation are met.

- The Loss and Damage dialogue under the Warsaw Mechanism is the international negotiation space for approaches and funding aimed at averting, minimizing, and addressing losses and damages in vulnerable countries. It offers an opportunity to trigger such necessary shifts, but its remit and distinction from adaptation has remained vague and focused on insurance-related solutions for sudden-onset risks.

- This policy brief proposes a comprehensive climate risk finance framework that expands the focus of Loss and Damage with provisions for transformational risk management to reduce risk and curative options to address residual impacts ‘beyond adaptation.

- Adapted social protection and national and global loss distribution schemes are suggested to attend to sudden-onset climate-related risks and impacts, such as those triggered by flooding. Instances ‘beyond adaptation’, such as retreat, need to be considered in addition to insurance-focused risk transfer.

- Funds are needed for ecosystem and livelihood restoration, as well as rehabilitation support to address slow-onset climate-related impacts and risks, such as loss of biodiversity and ecosystem services due to increasing heatwaves.

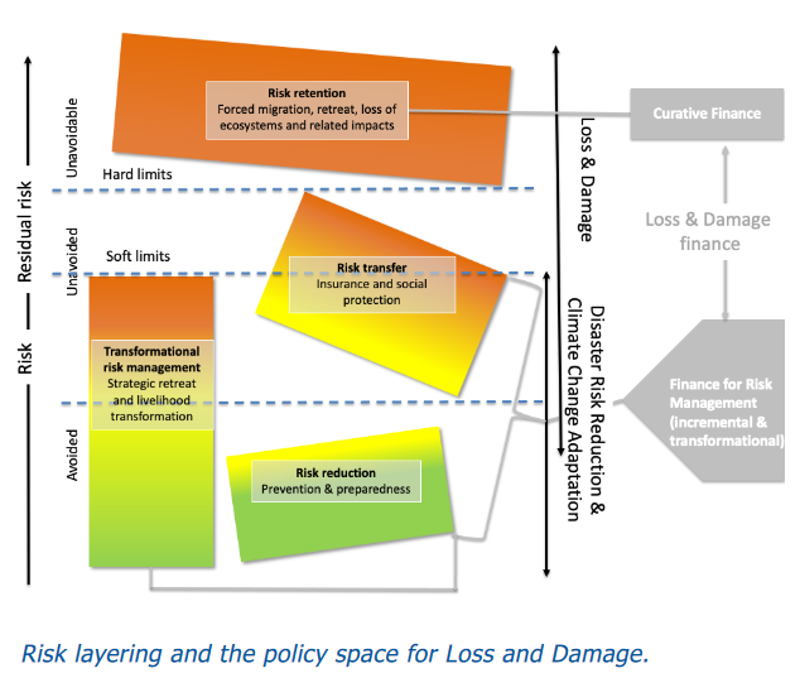

- Building on the tried-and-tested risk layering approach, the framework can be applied at different scales. It offers an entry point for a comprehensive approach that informs international negotiations on Loss and Damage and adaptation to climate change, as well as country-level policymaking. Decision makers need to step-up their game to set up an effective finance approach for increasingly existential climate-related risks.

A need to innovate risk management in an era of existential climate-related risk

The last year saw massive and increasingly existential climate-related events around the world, from wildfires to flooding to heatwaves. The Intergovernmental Panel on Climate Change (IPCC)’s Working Group I report has shown that with further global warming, the intensity and frequency of extreme events will increase. Some changes will be irreversible and global tipping points may be reached. IIASA research also found that local adaptation limits are drawing near, thus requiring a step-change in how climate-related residual risks are managed and financed.

As sea levels rise, flooding proliferates, and as heat becomes an existential threat, ecological systems succumb to changing temperatures and communities and countries will be forced to transform how they address climate-related risk – some to the point of abandoning their homes. Communities in the Global South, in particular, feel the brunt of these risks, but the problem is even more far-reaching, as provisions for managing the cost of increasing disasters are lacking across the globe. With international support, some vulnerable countries rely on insurance as a tool to manage these, with only a few having set up comprehensive public funding schemes to provide support for disaster-related losses. Similarly, funding for reducing risks from climate change and building resilience to mounting existential risks at the limits of adaptation is lacking, and even more so in developing countries where public coffers are especially short of cash.

Options for a step-change in a contested policy space

There is ample need to upgrade and transform the way climate-related risk are managed and how to face the mounting negative impacts caused by climate change, particularly in vulnerable countries across the globe. A step-change in how to provide that additional support is needed. One that is internationally negotiated under the headings of adaptation and particularly Loss and Damage from climate change ̶ both of which are highlighted at the 26th climate summit (COP26) in Glasgow.

The dialogue on Loss and Damage centers around who is to support the cost of residual losses and damages resulting from climate change and how. In 2013, the United Nations Framework Convention on Climate Change (UNFCCC) established the Warsaw International Mechanism (WIM) to avert, minimize, and address losses and damages associated with the impacts of climate change. Substantial progress has been made on enhancing understanding and dialogue on Loss and Damage, but less on facilitating concrete support for addressing it.

The policy space and a framework for answering calls for support have however remained vague. The ambiguous language of the Loss and Damage discourse refers to “averting, minimizing, and addressing” losses and damages, even though averting and minimizing are also covered by mitigation, climate change adaptation, and risk management, leaving the need to address losses and damages where it cannot be prevented. Particularly, the ‘addressing losses’ part is contested due to its implications for issues of financial compensation, litigation, and liability, and has so far predominantly been approached through insurance, such as through the Fiji Clearing House for Risk Transfer and the InsuResilience Initiative. While insurance options can be part of the solutions space, they cannot be the only way to address increasing existential risk at the limits of adaptation.

Bringing it all together

IIASA risk research and sustained policy engagement presents a way forward, while also harnessing increasing traction for a risk management perspective in the WIM Executive Committee and its expert groups. IIASA suggests a comprehensive policy and finance framework for Loss and Damage that relates to four layers of risk used in risk management practice, leading to two lines of action on risks and Loss and Damage. Building on the IIASA risk layering approach (see IIASA policy brief No. 4 of 2009), a proposal is made to delineate the Loss and Damage policy space for the Loss and Damage debate along the following lines:

1. Finance to support incremental and transformational risk management as well as risk transfer layers means direct funding to support adaptation, risk reduction, and resilience-building, thus turning unavoided risks into avoided risks. Transformational risk management is increasingly needed where standard approaches no longer work. Risk transfer means insurance in a broad sense. That may be through insurance markets, but often through international risk-transfer agreements such as contingency funds where nations pool resources to cover local emergencies. As complements, social protection, and other interventions need to receive additional attention.

Applications to key sectors and risks

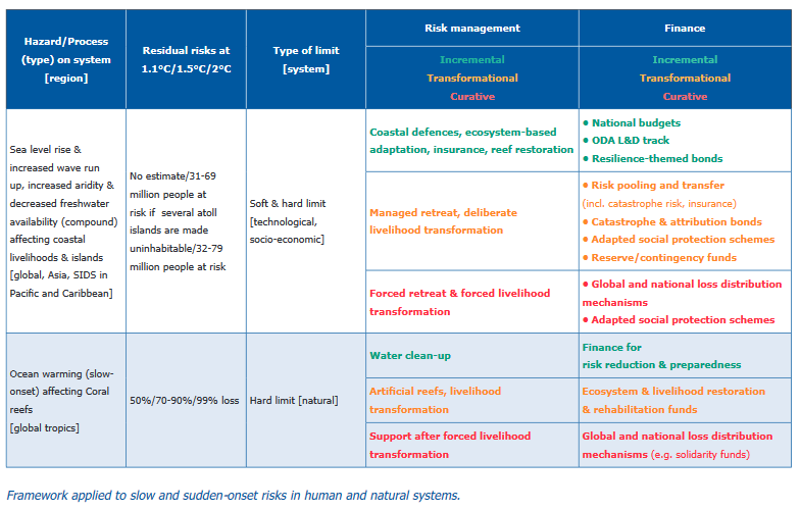

Who pays for further risk management and curative finance is a controversial question – but it has become urgent. Human and natural systems are already hitting or approaching soft and hard limits to adaptation. This includes millions of people in coastal regions in Asia and in Pacific and Caribbean small island states that are at risk of losing their livelihoods due to sea level rise, salinity, wave run-up, and other hazards. As an example of a largely natural system, there is a high chance that tropical coral reefs will be lost, stranding communities that once relied on them for ecosystem services, coastal protection, and livelihoods, including food and tourism ̶ even if warming is limited to 1.5°C.

The road ahead

The policy framework offers an entry point for a comprehensive risk management and finance approach that can inform international Loss and Damage and adaptation deliberations, as well as policymaking on disaster risk reduction at the country-level. Pilot testing at the scale of risk management can lead the way. In a world of increasingly systemic and existential risks, IIASA is helping to find solutions through enhanced research and engagement in UNFCCC expert groups, through its Loss and Damage research network, as well as by supporting community implementation as part of the Flood Resilience Alliance. In addition, IIASA is working with practitioners, researchers, and civil society leaders on a book that documents evidence on transformational risk management efforts across the globe (first insights are available here).

IIASA Policy Briefs report on research carried out at IIASA and have received only limited review. Views or opinions expressed herein do not necessarily represent those of the institute, its National Member Organizations, or other organizations supporting the work.